Difference between revisions of "Bank and cash module"

(→Setup) |

|||

| (8 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

= Introduction = | = Introduction = | ||

''It is important for an organization to possess one or more bank accounts for processing financial transactions. Management of bank accounts helps the organizations by keeping the records of all payments and receiving at one place. Hence, it is necessary for the ERP & CRM software to provide its customers with a safe interface to manage all of their bank related records and documentations effectively. Following the same, Tactic also provides an enhanced service in managing all the bank or cash accounts of an organization without having to face any difficulty.''This module helps the users to manage their bank accounts within a safe and secure interface. | ''It is important for an organization to possess one or more bank accounts for processing financial transactions. Management of bank accounts helps the organizations by keeping the records of all payments and receiving at one place. Hence, it is necessary for the ERP & CRM software to provide its customers with a safe interface to manage all of their bank related records and documentations effectively. Following the same, Tactic also provides an enhanced service in managing all the bank or cash accounts of an organization without having to face any difficulty.'' This module helps the users to manage their bank accounts within a safe and secure interface. | ||

= Installation = | = Installation = | ||

There is no need of installing this module, as it is already included within Tactic services. | There is no need of installing this module, as it is already included within Tactic services. | ||

= Setup = | = Setup = | ||

For using this module the users need to enable it by using an administrator account. The menu options for activating this module are: '''Home –> Setup –> Module'''. The users then need to click on '''Activate'''. The modules will be activated after completing this step. The settings icon will be visible at the end of the module box, the users can click in that to access setup. | For using this module the users need to enable it by using an administrator account. The menu options for activating this module are: '''Home –> Setup – > Module'''. The users then need to click on '''Activate'''. The modules will be activated after completing this step. The settings icon {{#fas:cog}} will be visible at the end of the module box, the users can click in that to access further setup for this module to access the functionalities in a better way. | ||

= Functionalities of Bank and Cash module = | = Functionalities of Bank and Cash module = | ||

| Line 11: | Line 11: | ||

= Creating a new bank account = | = Creating a new bank account = | ||

For creating a new bank account the users need to select '''Bank/Cash''' menu. '''New Financial Account''' need to be chosen for continuing the process. All the required fields need to be filled for completing the process. Lastly '''save''' need to be clicked for saving an account. | For creating a new bank account the users need to select '''Bank/Cash''' menu. '''New Financial Account''' need to be chosen for continuing the process. All the required fields need to be filled for completing the process. Lastly '''save''' need to be clicked for saving an account. | ||

[[File:Bank_1.PNG|center|link=]] | |||

[[File:Bank_2.PNG|center|link=]] | |||

[[File:Bank_3.PNG|center|link=]] | |||

The option of '''Modify''' needs to be clicked for modifying a bank account. | |||

[[File:Bank_4.PNG|center]] | |||

== Reconciliation == | |||

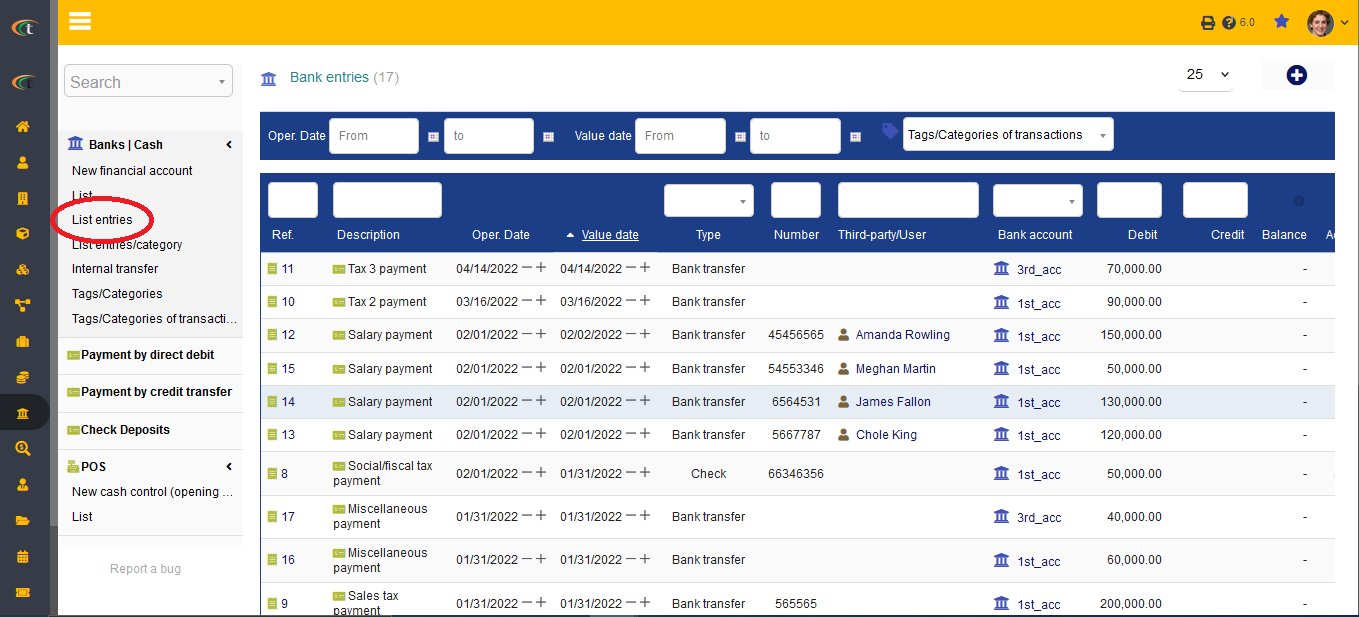

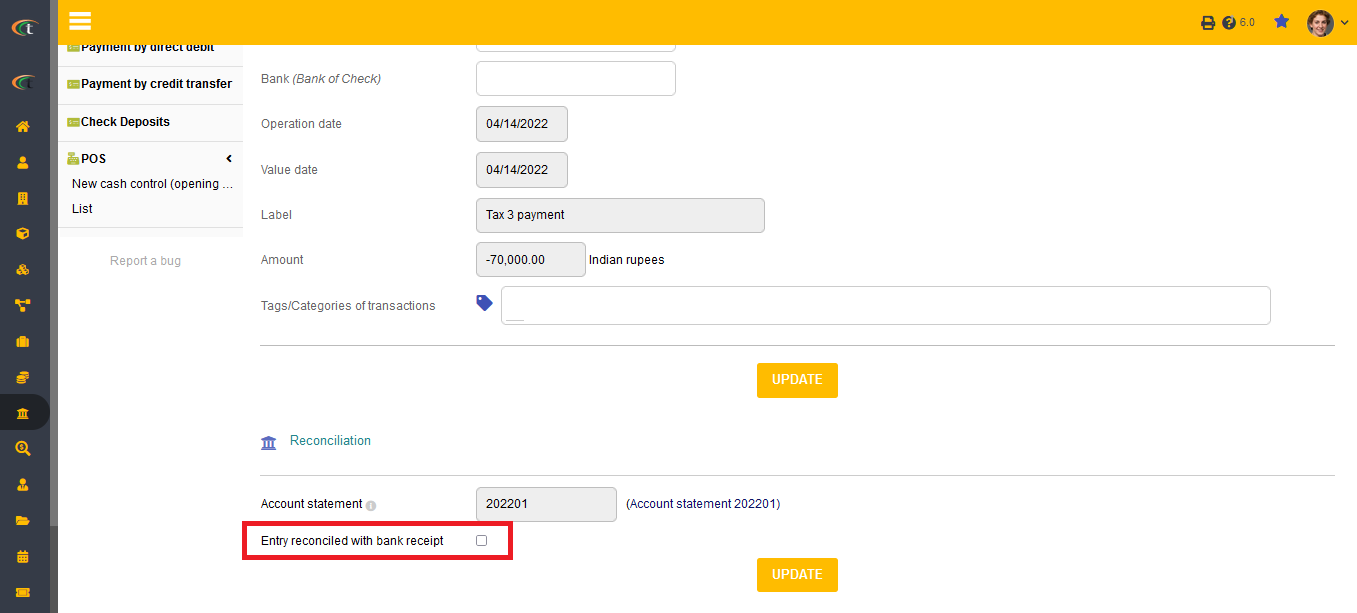

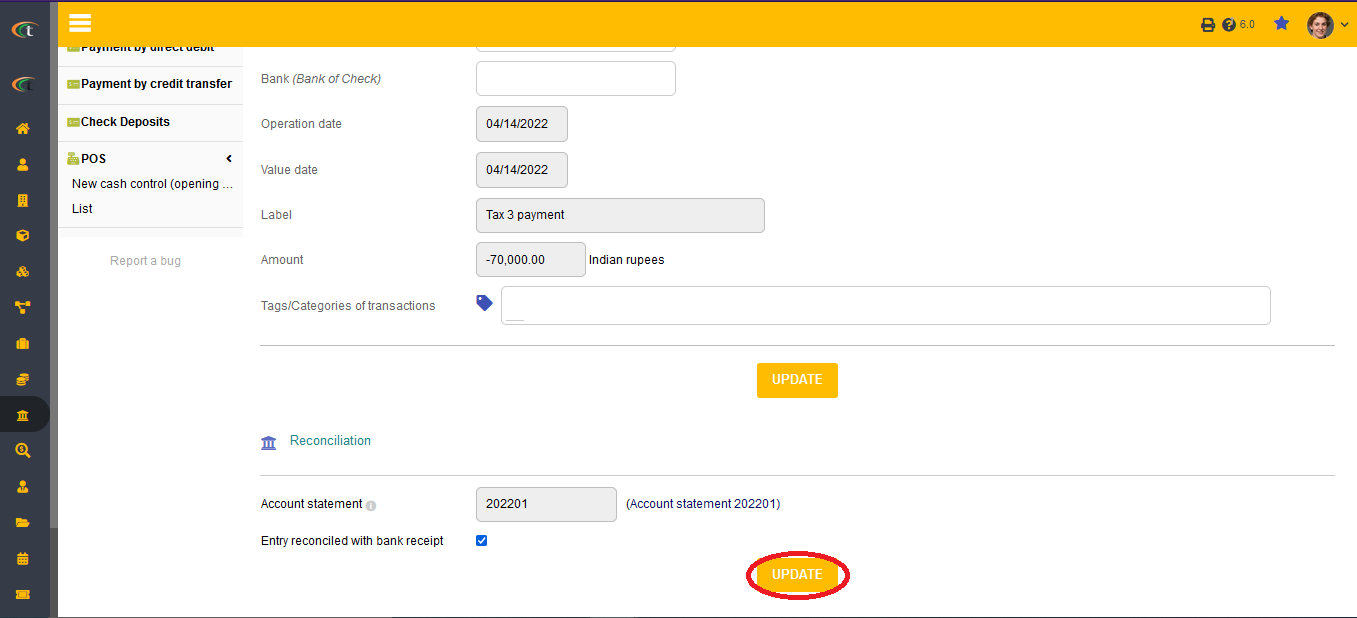

It is easy to opt for a reconciliation via Tactic with the help of bank module. You only need to turn on a settings by going to, bank menu -> List entries -> choose the concerned entry -> Click on the edit icon in the further right corner -> reconciliation -> click on the check box stating “Entry reconciled with bank receipt” -> update. Your bank reconciliation will be updated. | |||

[[File:Reconciliation_1.PNG|center|link=]] | |||

[[File:Reconciliation_2.PNG|center|link=]] | |||

[[File:Reconciliation_3.PNG|center|link=]] | |||

= Difference between a bank account and a cash account = | = Difference between a bank account and a cash account = | ||

| Line 20: | Line 54: | ||

= Deleting an account = | = Deleting an account = | ||

Bank and cash accounts cannot be deleted as they are always in use. Deleting a bank account can invite major issues, hence, the option of deletion has been omitted. | |||

Latest revision as of 09:30, 27 December 2022

Introduction

It is important for an organization to possess one or more bank accounts for processing financial transactions. Management of bank accounts helps the organizations by keeping the records of all payments and receiving at one place. Hence, it is necessary for the ERP & CRM software to provide its customers with a safe interface to manage all of their bank related records and documentations effectively. Following the same, Tactic also provides an enhanced service in managing all the bank or cash accounts of an organization without having to face any difficulty. This module helps the users to manage their bank accounts within a safe and secure interface.

Installation

There is no need of installing this module, as it is already included within Tactic services.

Setup

For using this module the users need to enable it by using an administrator account. The menu options for activating this module are: Home –> Setup – > Module. The users then need to click on Activate. The modules will be activated after completing this step. The settings icon will be visible at the end of the module box, the users can click in that to access further setup for this module to access the functionalities in a better way.

Functionalities of Bank and Cash module

Tactic provides an enhanced bank and cash services, which helps the users in managing their bank and cash transactions of an organisation. If an organisation receives a bank transfer or a cheque, the information will be updated in Tactic. However, if an organisation receives cash, the users can update the cash account for an effective user experience.

Creating a new bank account

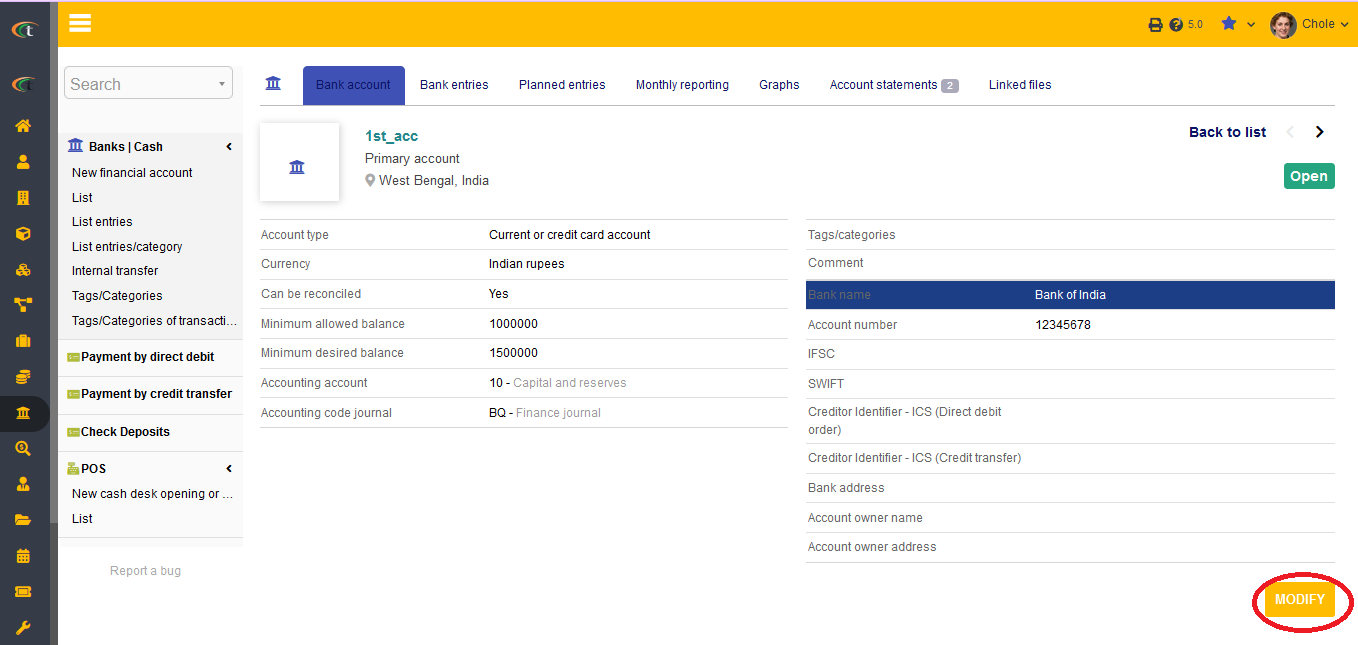

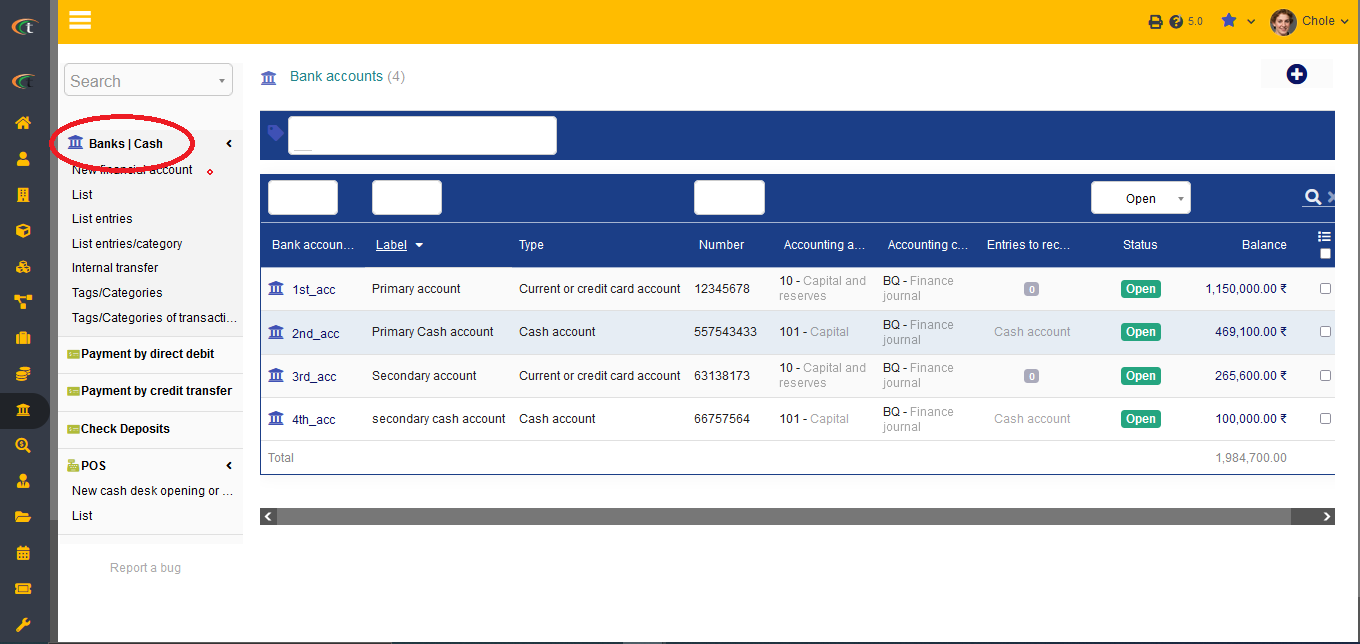

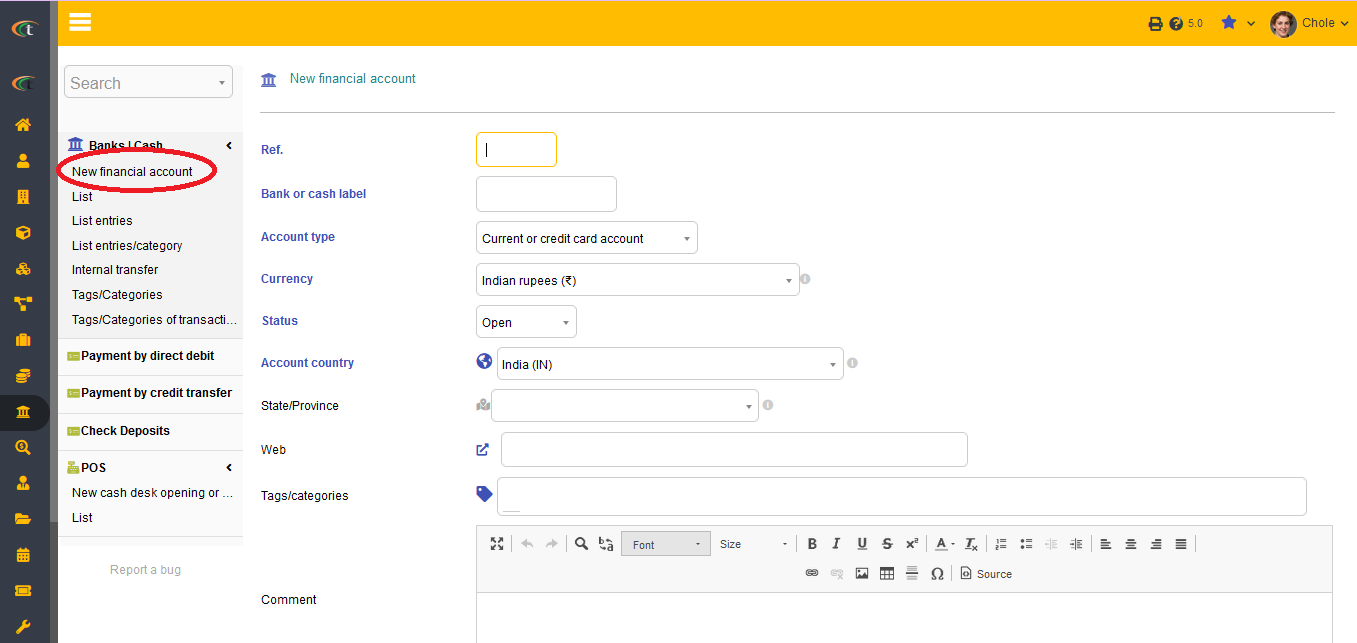

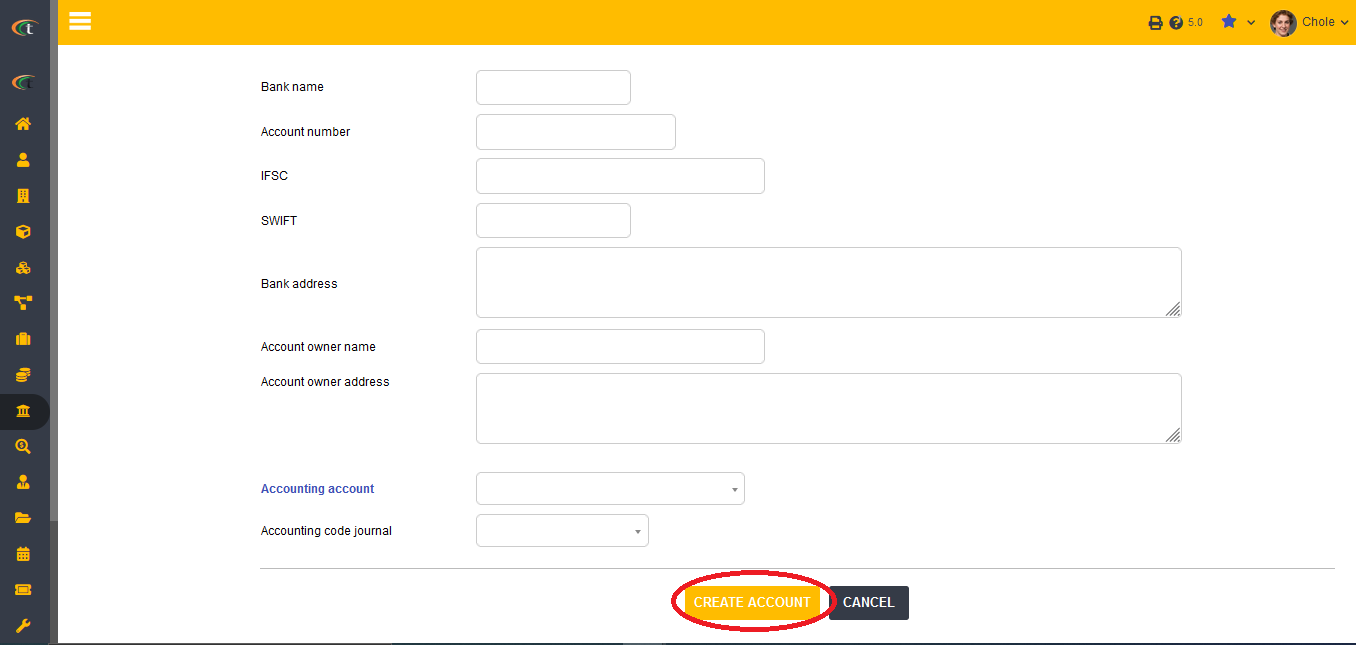

For creating a new bank account the users need to select Bank/Cash menu. New Financial Account need to be chosen for continuing the process. All the required fields need to be filled for completing the process. Lastly save need to be clicked for saving an account.

The option of Modify needs to be clicked for modifying a bank account.

Reconciliation

It is easy to opt for a reconciliation via Tactic with the help of bank module. You only need to turn on a settings by going to, bank menu -> List entries -> choose the concerned entry -> Click on the edit icon in the further right corner -> reconciliation -> click on the check box stating “Entry reconciled with bank receipt” -> update. Your bank reconciliation will be updated.

Difference between a bank account and a cash account

There is a basic difference between a bank account and a cash account, however, both are associated with a business organisation. A bank account is an account that is registered in a bank and the users need to perform financial transactions through cheques, bank transfers and credit cards. As a for cash account, the functionalities of the account is a bit different. A cash account is to register the cash amount that has been collected from a merchant or from a similar connection.

Tactic has an ability of creating more than one bank accounts and cash accounts. The bank accounts can be used or major financial transaction associated with an organisation. On the other hand, a cash account helps in managing the cash flow and amount of liquid cash within an organisation. The bank module in Tactic can help the users in drafting different bank details in one account and drafting cash account details under the safe interface as well.

Deleting an account

Bank and cash accounts cannot be deleted as they are always in use. Deleting a bank account can invite major issues, hence, the option of deletion has been omitted.